Intellectual Property Requires Careful Estate Planning

For estate planning purposes, intellectual property (IP) raises two questions: 1) what’s the IP worth and 2) how should it be transferred? You should also consider your income needs and who’s in the best position to monitor your IP rights and take advantage of their benefits. Contact the estate planning advisors at SEK for planning strategies that address IP.

Should your nonprofit compete, collaborate or both?

Not-for-profits often collaborate with other organizations with similar missions and values. But due to limited donor and grant maker resources, you also need to think about similar nonprofits as competitors. However, if a competitor has access to resources and connections you don’t (and vice versa) it may make sense to collaborate. Contact the nonprofit advisors at SEK with your financial questions.

Senior tax-saving alert: Make charitable donations from your IRA

Are you age 70½ or older and want to give to charity? You can make cash donations directly from your IRA to IRS-approved charities free of federal income tax with qualified charitable distributions (QCDs). Contact the tax advisors at SEK with questions.

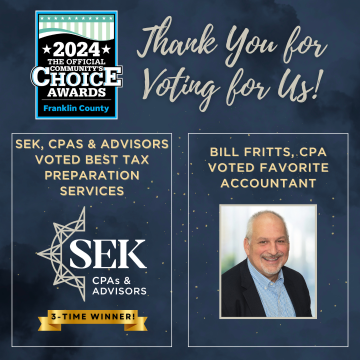

SEK named Best Tax Preparation Service in Franklin County’s Best Awards

SEK, CPAs & Advisors has been voted Best Tax Preparation Services in the Public Opinion’s Franklin County’s Best Community’s Choice Awards for 2024.

Kara Darlington elected Managing Member of SEK

SEK, CPAs & Advisors is pleased to announce the election of Kara Darlington, CPA, as the firm’s Managing Member, effective January 1, 2025.

Do you have a will?

When a person considers an “estate plan,” he or she typically thinks of a will. And there’s a good reason: A well-crafted, up-to-date will is the cornerstone of an estate plan. Let’s take a closer look at what to include in a will. Contact the estate planning advisors at SEK with questions.

How are you onboarding new hires?

Bringing a new hire into your organization is an exciting opportunity to strengthen your team and set the stage for long-term success. A well-thought-out onboarding process helps new employees feel welcome, aligned with your organization’s goals, and ready to contribute. Here are some practical suggestions for creating an effective onboarding experience.

Individuals: Use the annual gift tax exclusion to the max

With the holidays approaching, you might be considering making gifts of stock or cash to family members and other loved ones. By using your annual gift tax exclusion, those gifts, within generous limits, can reduce your taxable estate. For 2024, the annual gift exclusion amount is $18,000 per recipient. Contact the CPA's and business tax advisors at SEK with questions.

What nonprofits might expect from the change of control in Washington

The reelection of Donald Trump as President and control of the U.S. Congress by Republicans are anticipated to usher in changes that could financially impact the not-for-profit sector. Each organization will be affected differently, but in general, you may want to keep an eye on the following issues. Contact the nonprofit advisors at SEK with questions and concerns.

Healthy savings: How tax-smart HSAs can benefit your small business and employees

As a small business owner, managing health care costs for yourself and your employees is challenging. So you may want to provide some benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals, HSAs are a tax-advantaged way to set aside funds (or have their employers do so) to meet medical needs. Contact the business advisors at SEK with questions.