Facing a future emergency? Two new tax provisions may soon provide relief

Perhaps you’ve been in this situation before: You have a financial emergency and need to get your hands on some cash.

Don’t let IRS compliance issues drag down your nonprofit

In recent years, the IRS has increased its scrutiny of tax-exempt organizations. Most not-for-profits that fail to file Form 990 for three consecutive years will have their exempt status revoked automatically.

Valuations can help business owners plan for the future

If someone was to suggest that you should have your business appraised, you might wonder whether the person was subtly suggesting that you retire and sell the company.

Are scholarships tax-free or taxable?

With the rising cost of college, many families are in search of scholarships to help pay the bills. If your child is awarded a scholarship, you may wonder about how it could affect your family’s taxes.

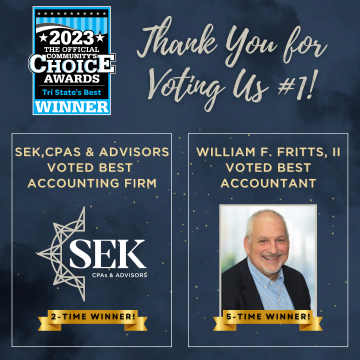

SEK wins two categories in Tri-State’s Best Awards

SEK, CPAs & Advisors won two categories in Herald Mail Media’s Tri-State’s Best Awards for 2023: SEK was voted Best Accounting Firm and William F.

Assessing lost business value as a source of economic damages

The survival of many companies depends on relationships between key customers or vendors (or both). When one of these relationships is disrupted, for whatever the reason, one party may incur financial damage — perhaps even leading to its demise.

Key financial metrics that matter for construction companies

Running a successful construction company requires more than just skilled labor and quality materials. It demands effective financial management to ensure profitability, mitigate risks, and sustain growth.

Have you coordinated your payable-on-death accounts with your estate plan?

Payable-on-death (POD) accounts can provide a quick, simple and inexpensive way to transfer assets outside of probate. They can be used for bank accounts, certificates of deposit and even brokerage accounts.

Joining forces with another nonprofit

A merger may seem like something that happens in the corporate world, where companies often combine to expand sales territory, gain competitive advantages and boost profits.

Senior Associate Morgan Landman named 2023 Rising Star

Morgan Landman, CPA, MBA, Senior Associate at SEK, CPAs & Advisors, has been selected as the 2023 Rising Star Award Winner by Cumber