Recent News & Blog / Individual Tax

What you can do to protect your financial future from the recent social security data breach

Over 2.7 billion Social Security numbers were found to be leaked in a recent data breach. Read how to protect your financial future.

6 tax-free income opportunities

There are ways to collect income and gains free from federal income tax. Contact the CPAs and tax advisors at SEK. Advance planning may lead to better tax results.

Comparison of Harris and Trump tax policy proposals

Presidential nominees Kamala Harris (D) and Donald Trump (R) are floating proposals ahead of what will be a consequential year for tax, with key provisions from the GOP’s 2017 tax overhaul (Public Law 115-97

Filing a joint tax return for the year of a spouse’s death can be beneficial

When a person dies, his or her personal representative (called an executor in some states) is responsible for filing an income tax return for the year of death. In some cases, filing jointly can provide tax savings, such as from a lower tax rate, larger tax credits and higher IRA contribution limits. Contact the CPAs and tax advisors at SEK for more information.

Are you liable for two additional taxes on your income?

High-income taxpayers may face two extra taxes: the 3.8% net investment income tax (NIIT) and a 0.9% additional Medicare tax. Income subject to the NIIT includes interest, dividends, annuities, royalties, rents, passive business income, and net gains from property sales. Wage income and income from an active trade or business aren’t included. Contact the CPAs and tax advisors at SEK to discuss extra taxes and how their impact may be reduced.

Working remotely is convenient, but it may have tax consequences

While there are lots of advantages to working remotely, it may also lead to some tax surprises, especially if a job crosses state lines. If you live in one state and work remotely for an employer in another state, you may need to file income tax returns in both states. Contact the CPAs and business tax advisors at SEK with questions about your tax situation.

Are you unfairly burdened by a spouse’s tax errors? You may qualify for “innocent spouse relief”

Navigating tax law complexities can be difficult, especially when faced with an unexpected tax bill due to the errors of a spouse or ex-spouse. In some cases, spouses are eligible for “innocent spouse relief.” If you’re interested in trying to obtain relief, paperwork must be filed and deadlines must be met. The process is challenging. The CPAs and tax advisors at SEK can assist you with the details.

Understanding taxes on real estate gains

Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. You may expect to pay the standard 15% or 20% federal income tax rate that usually applies to long-term capital gains from assets. However, some real estate gains can be taxed at higher rates due to depreciation deductions. The calculations are complex. The CPAs and tax advisors at SEK will handle them when we prepare your tax return.

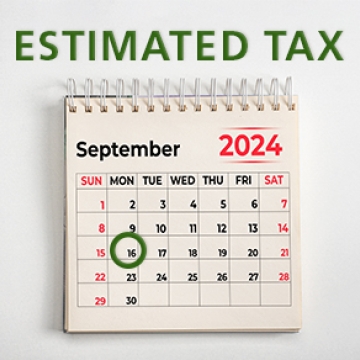

Do you owe estimated taxes? If so, when is the next one due?

Federal estimated tax payments ensure that certain individuals pay their taxes throughout the year. If you don’t pay enough during the year through withholding and estimated payments, you may be liable for a penalty on top of the tax due. Contact the CPAs and tax advisors at SEK with your tax questions.

The tax implications of disability income benefits

Many Americans receive private disability income. How is it taxed? It depends on who paid for the tax treatment depends on who paid for the insurance coverage. Contact the CPAs and tax advisors at SEK for help with your tax questions.