Recent News & Blog / Business Tax

Hiring your child to work at your business this summer

Are you hiring your child to work at your business this summer? Certain noncorporate entities can hire an owner’s under-age-18 children and their wages will be exempt from the following federal payroll taxes: Social Security tax, Medicare tax and federal unemployment (FUTA) tax. Contact the CPAs and business tax advisors at SEK to learn how to take advantage of these tax tips.

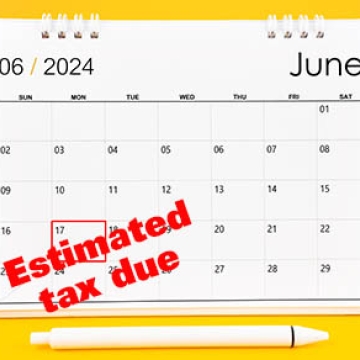

Figuring corporate estimated tax

The next quarterly estimated tax payment deadline is June 17 for individuals and businesses. (The normal June 15 due date falls on a Saturday, so it’s extended until Monday.) Let’s review the rules for computing corporate federal estimated payments.

Inflation enhances the 2025 amounts for Health Savings Accounts

The IRS recently released the inflation-adjusted amounts for Health Savings Accounts (HSAs) next year. Contact the CPAs and tax advisors at SEK with your tax questions.

Erroneous notices issued by IRS and PA Department of Revenue

Some clients are receiving late notices about their 2023 tax bill from the IRS. This is an error in the IRS systems.

Should you convert your business from a C to an S corporation?

The most common business structures are sole proprietorships, partnerships, LLCs, C corporations and S corporations. Choosing the right entity has many implications, including the taxes you pay. If you’re interested in an entity change, contact the CPAs and business tax advisors at SEK to learn about the tax implications.

Tax tips when buying the assets of a business

If you’re buying a business, you want the best results possible AFTER taxes. You can potentially structure a purchase in two ways: 1) Buy the business assets. 2) Buy the seller’s entity ownership interest. Contact the CPAs and business tax advisors at SEK for answers to your tax questions.

The tax advantages of including debt in a C corporation capital structure

Let’s say you plan to use a C corporation to operate a newly acquired business or you have an existing C corp that needs more capital. Be aware that the federal tax code treats corporate debt more favorably than corporate equity. Contact the CPAs and business tax advisors at SEK about your situation.

Growing your business with a new partner: Here are some tax considerations

There are several financial and legal implications when adding a new partner to a partnership. Although the entry of a new partner may seem simple, you should plan properly to avoid tax problems. Contact the CPAs and business tax advisors at SEK for more information and to answer your tax questions.

When partners pay expenses related to the business

It’s not unusual for a partner to incur expenses related to the partnership’s business. Your business should have a written firm policy that clearly states what will and won’t be reimbursed, including home office expenses. Contact the CPAs and business tax advisors at SEK for your business questions and for more tax tips.

When businesses may want to take a contrary approach with income and deductions

In general, businesses want to delay taxable income into future years and accelerate deductions into the current year. But they sometimes want to do the opposite. There are ways to accelerate income into the current year and delay deductions to later years. Contact the CPAs and business tax advisors at SEK for help and to answer your tax questions.