Recent News & Blog / How to set up a bookkeeping cycle in QuickBooks Online

December 3, 2024

Bookkeeping is cyclical. You tend to do the same things over and over, which may get to be a bit of a drag for you. QuickBooks Online can automate some processes, and it certainly helps minimize duplicate data entry, but you’ll undoubtedly find yourself growing weary of repetitive tasks.

We can’t help you avoid this drudgery completely, but we’d like to suggest a new, more organized way to attack your accounting tasks in 2025. It could be especially helpful if you’re a new QuickBooks Online user and don’t have a routine established yet. But even long-time users might find this routine helpful. It can keep things from slipping through the cracks and simply make you more productive and confident that you’re addressing all of your accounting issues

Give it a try and see what you think.

What should you do every day?

Even if you don’t have expenses to enter or invoices to process, it’s a good idea to log into QuickBooks Online every day. If you’ve connected your online bank and credit cards to the site (which you absolutely should), there will probably be transactions to go over. So after you’ve taken a look at your Dashboard (especially your Tasks), hover your mouse over Transactions in the toolbar and click Bank transactions.

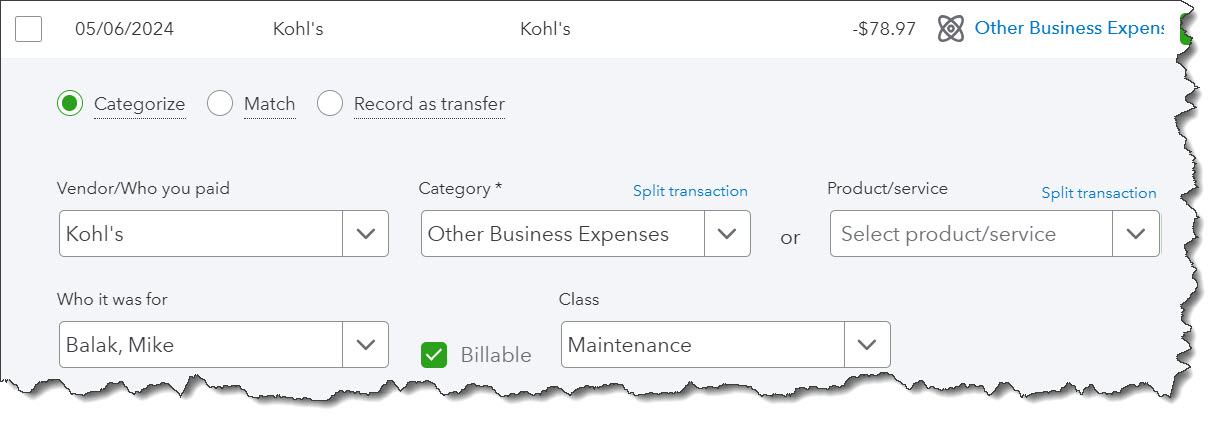

Click Update in the upper right to make sure you’re seeing the most recent transactions. If you’re doing this every day, it shouldn’t take long to go over the income and expenses that have been imported since you last logged in.

You should be looking at newly imported transactions daily and completing the fields provided as comprehensively as possible.

If you don’t know what Match or Record as transfer mean, we should schedule a session to go over transaction management in QuickBooks Online.

Every week

You need to be monitoring your accounts receivable and payables on a weekly basis – at minimum. There are two ways to do this. You can:

Run reports.

- Click Reports in the toolbar and scroll down first to Who owes you. Run Accounts receivable aging summary. QuickBooks will display past-due transactions in several columns (Current, 1-30 days, 31-60 days, 61-90 days, and 91 and over). If you’re keeping up with your receivables, you shouldn’t be seeing numbers in most of the columns, unless you’re in a known collections process.

- Scroll down to What you owe and run Accounts payable aging summary. This works like the aging receivables report. Again, you shouldn’t be seeing much activity here unless you’re in a payment dispute with a vendor.

- You can also run the Open Invoices report to quickly see the Due date and Open balance entries here. Ditto the Unpaid Bills report.

Consult the All sales page.

Hover your mouse over Sales in the toolbar and click All sales. The colored bars and numbers at the top of the page show you the status of your sales. Click the orange bar in the middle to see a list of overdue invoices. If there are any, you can set a Send reminder by clicking the corresponding down arrow in the Action column. While you’re there, look at estimates and unbilled income and take any action needed.

Every two weeks (or more often, depending on product volume)

If you sell products and track inventory in QuickBooks Online, you should keep a close eye on your stock to see if you need to:

- Reorder,

- Bring in a larger supply because something is selling well, or,

- Discount or discontinue a product because it’s not selling.

Click Reports in the toolbar and run Product/Service List under Sales and customers and look at the Quantity on hand column.

Every month

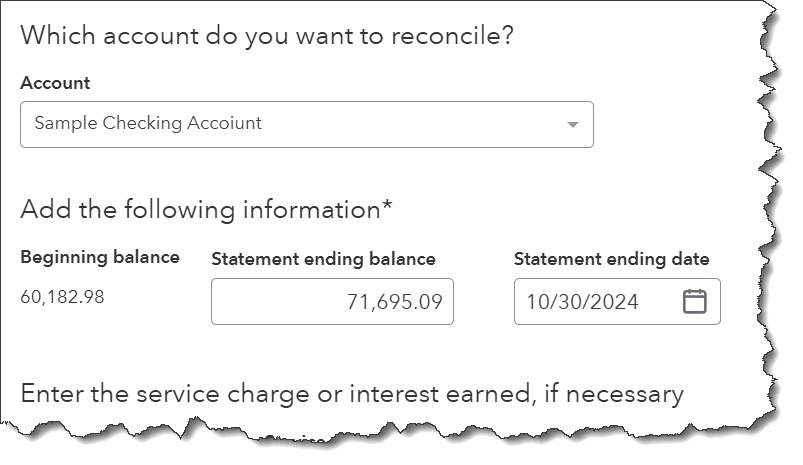

Reconcile your accounts (Transactions | Reconcile).

It’s really, really important that you reconcile your accounts every month. We can help you with this.

No one likes to do this, but it’s way easier to do regular reconciliations than it is to have to go back several months to track down a problem. If you’ve never done this in QuickBooks Online, it works similarly to how you used to reconcile your accounts by comparing a bank statement and your paper checkbook register. Only you’re comparing your bank or credit card statements to your accounts in QuickBooks Online. Before you start, make sure you’ve matched and categorized all of your downloaded transactions.

Run a Profit and Loss report for the last month.

Click Reports in the toolbar and click Profit and Loss under Business overview. Did you make a profit last month?

Every quarter

If you’re planning to apply for a loan or looking for an investor, or if you just want a deeper understanding of how your business is doing, consider having us create and analyze standard financial reports for you, like the Balance Sheet and Statement of Cash Flows. You can run these yourself in QuickBooks Online, but it really takes an accountant’s eye to understand and interpret them.

If you decide that you want to work with us in any capacity, like helping you with reconciliation and/or modifying your Chart of Accounts, there’s another way we can help. If you ever have trouble categorizing an expense, select Uncategorized Expenses as the Category. If we’re meeting with you once a month, we can run a report on these and help you categorize them correctly.

In the meantime, we wish you a happy holiday season, and hope 2025 is a great year for your business.

QuickBooks year-end tax forms update

Beginning in January 2025 (for the 2024 tax season), QuickBooks Online Payroll will no longer include the cost of printing and mailing W-2 tax forms in its subscription. Instead, there will be a $4 fee per employee for this service. Learn more here.