Recent News & Blog / Comparison of Harris and Trump tax policy proposals

September 10, 2024

Presidential nominees Kamala Harris (D) and Donald Trump (R) are floating proposals ahead of what will be a consequential year for tax, with key provisions from the GOP’s 2017 tax overhaul (Public Law 115-97) set to expire. Let's look at the expiring tax provisions, each of the candidate's individual and corporate tax proposals, and the international tax rules to watch.

Expiring Tax Provisions

- Trump and Republicans generally want to extend, and potentially expand, their tax cuts.

- Harris has echoed Biden proposals to not raise taxes on those making less than $400,000.

| Individual Rates | Marginal tax rates for individuals will revert to pre-2017 levels, including maximum rate of 39.6%, from 37%. Standard deduction amounts will be lower by almost half and adjusted for inflation. |

| SALT Deduction | The $10,000 cap on state and local tax deductions will no longer apply. |

| Business Provisions | Bonus depreciation – which allows immediate deduction for capital investments – phases out after 2026. Pass-through businesses will no longer be able to deduct up to 20% of qualified income. |

| Child Tax Credit | Maximum credit will drop to $1,000 per child, from $2,000. Phaseout threshold will decrease to $75,000 for individuals and $110,000 for married couples. |

| Estate and Gift Taxes | Exemption from estate and gift taxes reverts to pre-2017 level of around $5 million, adjusted for inflation. The 2024 exemption is $13.6 million. |

| Paid Family and Medical Leave Credit |

Credit for employers who provide up to 12 weeks of paid family and medical leave per employee expires. |

Individual Tax Proposals

| Harris |

|

| Trump |

|

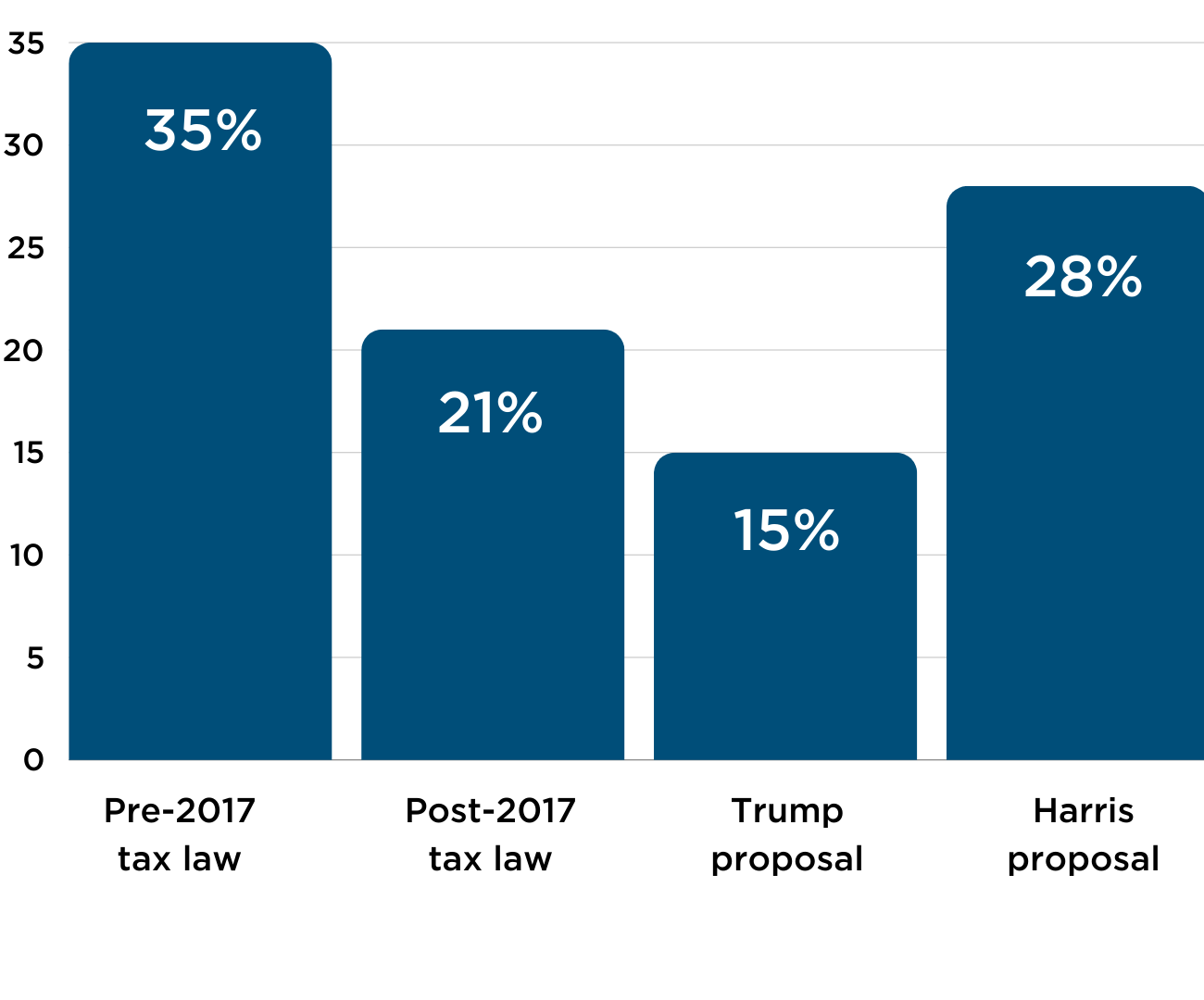

Corporate Tax Rates

In 2017, the tax law reduced corporate tax rate to 21% from 35% without an expiration.

International Tax Rules Largely Unaddressed in Campaigns

| BEAT/GILTI |

Effective rate of GILTI tax – the US minimum tax on foreign income tied to intangible assets, such as patents – will increase to 13.125% in 2026, from the current 10.5%. The BEAT tax – intended to deter large US multinational corporations from shifting profits to low-tax countries – will increase to 12.5%, from 10%. |

| FDII |

Deduction rate on excess foreign intangible income will decrease to 21.875% from 37.5% in 2026, increasing the effective tax rate on such income. Recent Biden administration budgets proposed a repeal of FDII deduction. |

| Global Tax Deal |

Biden administration proposed modifying GILTI and replacing BEAT with an undertaxed profits rule to align with Pillar 2 minimum income tax structure under the OECD global tax deal. Pillar 1, which would change where large companies pay taxes, effectively requires US adoption to take effect. International negotiations on the terms of the Pillar 1 structure continue. |

The 2024 tax proposals from Democrats and Republicans present voters with a clear choice between two divergent paths for the nation’s economic future. Understanding these proposals and their potential impacts will be crucial for voters as they decide which direction they believe will best serve the country’s interests in the years to come.

Disclaimer: This comparison is intended to provide an overview of the tax proposals from both major political parties for the 2024 election. The information presented is for informational purposes only and should not be interpreted as a statement of support or opposition to any political viewpoint.

Related Article: Possible tax landscape for businesses in the future